Historical Overview of Banking

Before we move on to evolution of banking in Pakistan, it would be quite interesting to have a glimpse of historical evolution of banking over a period of time.

Today, we look around us chain of banks rendering host of services to their customers. These banks cater to the commercial and industrial needs of all countries which include die highly developed and industrialized countries, the less developed countries and the countries which are at the take-off stage. Thus there are the industrial banks, the commercial banks, the joint stock banks, the co-operative banks, the agricultural banks, rural development banks, lead banks and so many other types of banks and credit institutions which are functioning. They not only meet the requirements on a national basis, but also on an international basis and what may be called as an ever expanding advancement in banking. The Banks now-a-days are performing so many functions that it would not be a misnomer to suggest that they have become the custodian of the monetary economies of the world. When we talk of great scientific developments and inventions, banking as it stands today is also a wonder of the world.

Banking as we see today is the result of evolutionary development during the course of centuries. It would also be necessary to see how Banking has come to its present stage. There has been all round development in the world and the banking today is not what it was in the earlier rudimentary form. To develop true perception, we need to know as to in what manner Banking today has come to be what it is and in what manner this transition has taken place.

The banking system, as it exists today, is the product of a number of centuries and is not the development of any particular period. In all the countries of the world. Banking has been in existence in one form or the other. So far as the present system is concerned, the word, bank is said to be of Germanic origin, cognate with the French word banque and the Italian word, banca, both meaning bench. In fact, this word may have derived its meaning from the practice of Jewish money-changers of Lombardy, a District in North Italy, who, in the middle ages, used to do business sitting on Benches in the market place. In case such an interpretation is provided, then it also finds support from a number of other derivations of the word such as the French word, Bancjue Route and the Italian word, Banka Rotta, both of which mean Broken Bench. This practice can be understood if we analyze the situation when a money-changer failed and his bench was broken as a result of his failure.

Macleod, however, does not agree with this view and says, "The Italian money-changers as such were never called Benchieri in the middle ages". It may be more correct to say that the word bank is derived from the German word back which means a Joint Stock Fund, which was Italianized into Banco, when the Germans were me masters of a major part of Italy. Professor Ram Chandran Rao has said: "whatever be the origin of the word bank, it would trace the history of banking in Europe from the middle ages

When we come to the Roman age, the State Banks were not functioning but there were private banks duly regulated by the Government. Aristotle stated that:

"Charging of interest on money was unnatural and immoral and on this account, banking could not develop for sometime."

.

We should also remember that in ancient times, commercial banking was associated with the business of money-changing. They also met the financial requirements of the ruling government. Adam Smith has stated as under:

"The earliest banks of Italy, where the name began, were finance companies..... to make loans to and float loans for the government of cities in which they were formed.... After these banks had been long established, they began to do what we call banking business, but at first they never thought of it.

It was only in the 12th century that the Banks, in the modem sense of the term, were established in Venice and Geneva, which were doing the business of receiving deposits and lending money, and were not only money-lenders. In Florence alone, there were about 80 bankers known to the whole of Europe such as Bardi, Medici, Peruzzi and others of great repute. The Bank of Venice founded in 1157, was the first Public Banking Institution. The Bank of Barcelona and the Bank of Geneva were established in 1401 and 1407 respectively and the Bank of the Venice and the Bank of Geneva continued to operate until the end of the 18th Century. The private banking houses such as the famous house of Fuggers and Augsburg enjoyed more eminence than Peruzzi and Bardi in the 14th Century and the Medici in the 15th Century in Italy. The bankers of Lombardy settled in the locality which is now known as the famous Lombard Street in London and to them belonged the credit of planting the seed of modem banking in England. Public banks like the famous Bank of Amsterdam was established in 1609 and these banks helped in the development of trade and commerce. These banks received heterogeneous metallic money and credited deposits in their books which were transferable through bank cheques. Thus, the mercantile payments now began to be settled by means of payment through cheques.

In Britain, people used to deposit their cash and bullion at the Royal Mint having faith in the King and the royal family as an institution.

Edward III exchanged various foreign coins and provided foreign exchange to the travelers and also supplied British money.

This faith was betrayed by Charles I in 1640 A.D. by capturing a very big amount of £1, 30,000 bullion left for safe custody with the Royal Mint. The merchants then started entrusting their valuables and cash to their cashiers, who also misappropriated them, and the merchants took resort to goldsmiths for keeping custody of valuables in their strong rooms. These goldsmiths used to give receipts which were known as Goldsmith's Note, which was made payable to the bearer and on demand which transformed the said receipt into the position of a bank-note which gained circulation and currency in due course of time. These notes with the passage of time became payable to the bearer on demand and enjoyed circulation. Thus, we can say that the goldsmiths became the precursor of the modern, bank-note and the fore-runners of the modem banking institutions.

Thus the development of banking in England was greatly helped by the activities of the London goldsmiths during the age of Queen Elizabeth L For sometime, the deposits were made without interest. Later on, the goldsmiths tarred lending these amounts to others like that of Dutch Bankers and when it was found profitable by them, they started giving interest on this money to their customers instead of charging any fee for safeguarding their money. The goldsmiths started giving loans for long duration and some money was kept by them for daily payments. The trouble arose when Charles 11 under the Cabal Ministry borrowed heavily from them and repudiated all debts there by the goldsmiths as well as English Banking received a rude setback.

Walter Bagehot has stated that the government perpetrated one of those monstrous frauds which are likewise gross blunders. Charles II set up the Exchequer. He would pay to none and as has been stated by Geoffrey Crowther the goldsmiths were ruined. As a result of this, there was the growth of private banks which finally led to the establishment of the Bank of England in 1694. It is again interesting to refer to Geoffrey Crowther to trace the history of modem English banking, who has stated as under:

"The present-day banker has three ancestors of a particular note. One we have already met; the merchant, whose high and widespread reputation or credit enables him to issue documents that will be taken all over the known world as titles to money. To this day the title of "merchant banker” is reserved by usage to the older cosmopolitan and more exclusive private banking firms, nearly every one of which can trace its ancestor to a trader in commodities, more tangible (though hardly more profitable) than money. The banker's two other ancestors are the money-lenders and the goldsmiths. Lending and borrowing arc almost as old as money itself and the village money-lender is found even in quite primitive communities. He is not usually regarded as a very lovely object; usurer is one of the oldest terms of abuse. But the services he performs are undoubtedly useful and necessary, even though the reward he extracts in return may usually be rapacious..... The goldsmith ancestor of the modern bank is purely an English affair.

The goldsmiths were loosing their faith and earned a bad reputation for sometime and people doubted their bona fides. However, they started a new system of having current account with them and the borrowers could withdraw money at any time. This was the stage which gave birth later on to the present banking system. Till then, there was no public bank: The Bank of England was started in 1694 A.D. with its monopoly of issue of notes. There were joint stock companies doing banking business- and they were flourishing in London. These companies introduced deposit banking and cheque currency and many other services which a bank can offer.

So far as the Bank of Amsterdam is concerned, it was one of the greatest banks of the 17th century and its position was not less than the position which was held by the Bank of England. In fact, it had importance in the international world as a whole and one can get a good reference about the working of these banks from Alfred Marshal} who in his book, "Money, Credit and Commerce, 1923", has slated that these famous banks besides, acting as the fiscal agents for the government, were also responsible for the counterpart of such of the work of the modem stock exchanges. In fact, these banks acted as go-between the lenders and borrowers of funds and also as the holders of cash and old securities. In this connection, it would be interesting to refer to Adam Smith who in his famous book, "Wealth of Nationsf/, published in 1776, has described the main function of the Bank of Amsterdam as under:

"This bank received both foreign coin, and light and worn coin of the country at its intrinsic value in the gold standard money of the country, deducting only so much as necessary for defraying the expense of coinage, and the other necessary expense of management. For the value which remained, after this deduction was made, it gave a credit in its books. This credit was called bank money which, as it represented money exactly according to the standard of the mint, was always of the same real value, and intrinsically worth more than current money...., it could be paid away by a simple transfer, without the trouble of counting or the risk of transporting it from one place to another.

We have already seen that the Bank of England was started in 1694 as a result of the actions of Charles II who had borrowed very heavily from the goldsmiths and like his father had repudiated his debts. The Bank of England was also started on account of the financial difficulties of William III who was at war with France. Patterson suggested a way out of difficulties and offered to rise of £1,200,000 which he was prepared to loan to the government if certain concessions including the right to issue notes were given to the proposed institution. For this purpose the Tonnage Act was passed. In the year 1708 another important Act was passed which prohibited any other bank with more than six partners from issuing promissory notes and bank-notes. This Act gave the monopoly of note issue to the Bank of England, so far as the Joint Stock Banks were concerned, but left private banks having not more than six partners free to issue notes. These banks however, thought that the business of note issue was not profitable and they gave it up. Printed cheques were issued for the first time between 1749-59. The Bank of England did not have any branch outside and the private banks started playing an important role. After the middle of the 18th century there were about 300 banks. Then came the crisis of 1825 and it tolled the death knell for the small country banks and of the note as the foundation of the banking system. In 1826 an Act was passed which allowed the banks to be started with unlimited liability, consisting of more than six partners, with the right to issue note provided they had no office within the radius of sixty-five miles from London. Thus the new joint stock banks were started. Even at this time the monopoly of note issue given to the Bank of England by the Act of 1708, was interpreted to mean monopoly of Joint Stock Banking in London because during those days note issue was regarded as the most important as well as the most paying function of banks.

The modem banking institution had to wait for another century and four decades until the passage of the Banking Act of 1833 which provided for the establishment of the Joint Stock Banks.

In 1833, when the Charter of the Bank was revised, as a result of the studies made by one Joplin, a new clause was added and it gave legislative sanction for the establishment of Joint Stocks Banks in London and in 1834, The London and Westminster Bank was started in England, which is the first of the big five ones. In 1844 Peel Act was passed which provided for the extinction of the right of note issue and laid the foundation of the note by Bank of England. With the passing of the Peel's Act, 1844, new banks with the right of note issue could not be started and those which already existed could not increase their circulation and thus greater emphasis was thereby laid on deposit banking and cheque currency.

There was amalgamation of banks after 1890 and the number of Joint Stock Banks in England and Wales came down from 104 in 1890 to 12 in 1956 although the number of bank offices increased from 2203 to 10700 by the end of 1961. The Currency and Bank Note Act, 1920 also regulated the issue of bank-note. The Securities Management Trust Ltd. was organized in 1929. In 1930 Bankers Industrial Development Corporation was formed. In 1947, the Labor Government nationalized the Bank of England and the power to appoint its Governor, Deputy Governors and Directors was vested in the Crown. This Act of the Labor Government had significant impact throughout the world.

“An Act to regulate the acceptance of deposits in the course of '. business; to confer functions on the Bank of England with respect to the control of institutions carrying on deposit-taking businesses; to give further protection to persons who are depositors with such institution to make provision with respect to advertisements inviting the making of deposits; to-restrict the use of names and descriptions associate with banks and banking; to prohibit fraudulent inducement to make deposit; to amend the Consumer Credit Act, 1974 and me law wit respect to instruments to which section 4 of the Cheques Act, applies; to repeal certain enactments relating to banks and banking; and for purposes connected therewith.”

The significance in law of the terms 'bank’, banker' and 'banking business" depends upon the particular operation which is in question an upon the particular statute/if any, under which the question arises. To take an obvious instance, only a banker may reap the benefit of the protective sections contained in different statutes.

In short the effect of the Banking Act, 1979 is, generally speaking, that a person or institution may accept deposits in the course of carrying on deposit taking business for the purposes of the Act unless he or it is a party recognized or licensed by the Bank of England or he or it is exempted or its business falls within the exceptions of section 1(3) or, again, the deposit is I the type included in sub-section (5). Vide section 1(4), 'deposit' is defined as sum of money paid on terms:

(a) Under which it will be repaid, with or without interest or premium, and either on demand or at a time or in circumstances agreed by or on behalf of the person making the payment and the person receiving it; and

(b) Which are not referable to the provision of property or service or the giving of security?

The penalty for contravention is liability to a fine or imprisonment both; but the civil liability of the acceptor of the deposit is not affected.

Thus so far as the English banking system is concerned, the entire matter is now covered by the Banking Act, 1979 which governs all the important aspects of the banking life in England

As per Sheldon's "Practice and Law of Banking", 10th Edn., p. 163, so far as the classification of banks is concerned, firstly, there is the Bank of England, incorporated by Royal Charter and not affected by the Companies Act. Secondly, there are the National Saving Banks, the National Giro and the Trustee Saving Banks. Thirdly, there are the great Joint Stock Banks, registered under the Companies Act with limited liability. Fourthly, there is at least one Joint Stock Bank with unlimited liability, namely, C. Hoare & Co., Coutts & Co. which is now a wholly owned subsidiary of National Westminster Bank Ltd. though it is still a clearing bank in its own right. There used to be many banking partnerships with unlimited liability but, with N.M. Rothschild & Sons becoming a limited company in 1970, it seems that there remains no banking partnership in England and Wales of any size. , Fifthly, there are the Scottish, .Irish, Overseas and Foreign Banks whose principal places of business are outside the precincts of England and Wales. Some of the earlier overseas banks were incorporated by Royal Charter, e.g., the Chartered Bank, British Bank of the Middle East, and so on. Sixthly, there are so called Merchant Banks, which are now without exception incorporated under the Companies Act, the shares of many of them being quoted on the London Stock Exchange. These banks are engaged in deposit banking but their more important role is in the provision of finance, both by way of loan and acceptance credit and in acting as financial advisers to a large range of commercial companies/especially where 'take-over bids', mergers and amalgamations are concerned. Most of them are also prepared to act as investment advisers.

In conclusion, we can say that banking is not a static rather it is a dynamic concept. It is product of centuries and the development which has taken place is the product of the method of trial and error and experiences which were made and the results that followed relating to the acceptance of money and valuables as deposits, keeping them as such, lending them, whether to private individuals or to states or other bodies and for controlling the multifarious and multi-dimensional activities which in the beginning were only trivial and could be ignored but with the growth of time, became international in character and multi-dimensional in nature calling for actions on the part of the states as the actions on the part of the individuals failed and state control became eminent. Thus, one cannot understand the development of banking merely by looking at a particular period of time and one will have to consider the development by taking into account the progress as it has taken place during the centuries and by understanding the movement from one stage to the other.

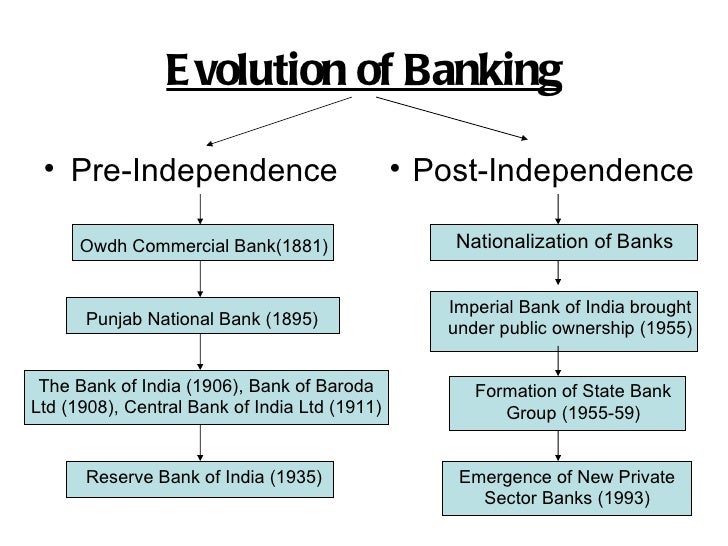

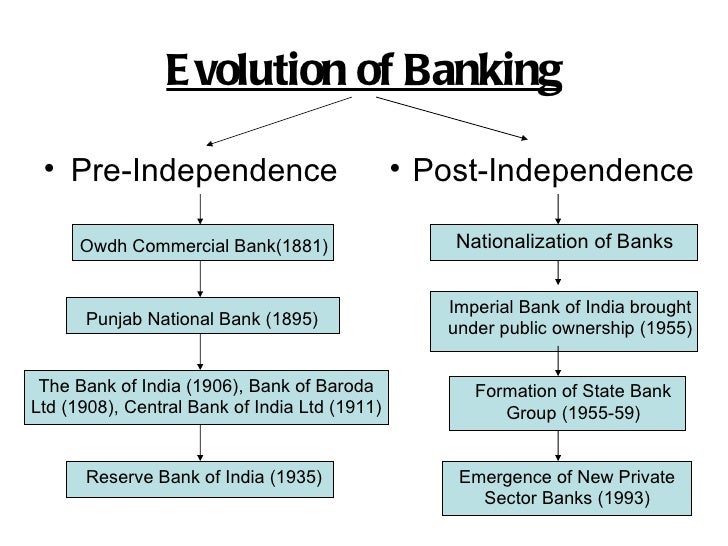

Evolution of banking in Pakistan:

Commercial banks constitute the most important source of institutional credit in the economy. As the country’s largest deposit institutions and the main source of short-term credit, they form the heart of the financial system.

At the time of independence, there were two banks incorporated in the undivided India in first half of 1940s’ whose owners were Muslims. After independence they decided to establish their head office in Pakistan, thus laying the foundation of banking in this country.

The National Bank of Pakistan was set up in November 1949 in crises conditions following the first trade deadlock with India. The original intention was to establish it sometime in 1950. The plans for its establishment had to be advanced in view of the critical situation, which developed especially in the jute trade as a result of India’s refusal to accept the exchange rate of the Pakistani Rupee following the Indian devaluation of 1949. The bank was set up through an Ordinance on 19 November 1949 and started its operations with five offices located at important jute centres. It played a notable role in financing the jute trade in collaboration with the Jute Board. In 1952, the National Bank of Pakistan took over the agency work of the State Bank of Pakistan to transact government business and manage currency chests at places where the state bank did not have an office of its own.

Prior to nationalization, the government owned 25 percent of the share capital while others held the remaining 75 percent. Following nationalization, the capital held by others was transferred to and invested in the federal government. Prior to nationalization, a Central Board of Directors governed the National Bank but consequent upon nationalization, the Central Board was dissolved and in its place an Executive Board consisting of a President who is the chief executive and four other members were appointed for the general direction and superintendence of the affairs and business of the bank.

All Pakistan banks were nationalized with 100 percent federal government ownership in 1974 and by now all nationalized banks stand disinvested and privatized. These aspects shall be discussed in detail in due course of time’

There were as many as thirty-four foreign banks with 172 branches at the time of in dependence. With the closure of many of the banks, the number had declined to twenty-one by June 1980. The Indian Banks, which numbered nine were entrusted to the Custodian of Enemy Property after the 1965 Indo-Pak war. Among foreign banks, a distinction was usually made between banks having their head offices in India and those with head offices in other countries. Foreign banks, other than the Indian banks, were commonly known as exchange banks in the early years. The term owed its origin to the fact that, prior to independence; foreign banks in the Indo-Pakistan subcontinent were engaged primarily in the financing of foreign trade. Seven exchange banks incorporated abroad were operation in Pakistan at the time of independence. Most of thse banks were of British origin. There were twenty-nine Indian Banks operating in the territories of Paksitan at the time of Independence but they gradually curtailed their business and their number stood at nine in 1965 when they were taken over by the Custodian of Enemy Property. The banks that were taken over were: (1) State bank of India; (2) Central Bank of India Ltd.; (3) Bank of India Ltd.; (4) United Commercial Bank Ltd.; (5) Punjab Commerce Ltd.; (7) United Bank of India Ltd.; (8) Bank of Baroda Ltd.; and (9) United industrial bank Ltd. Besides, there were as many as twelve non-schedule Indian banks which were also taken over by the Custodian of Enemy property following the 1965 Indo-Pakistan War.

Very few foreign banks have been attracted to Pakistan during the financial liberalization period. Indeed several have sold out to private Pakistani banks and terminated operations in Pakistan.

Evolution of Commercial Banks in Pakistan

As already discussed that at the time of independence, there were only two banks, which were incorporated in undivided India and whose owners were Muslims ,they opted to shift their Head Offices in Pakistan. With the establishment of SBP, the other banks also came into existence and by 1973 number of banks increased to fourteen.

Nationalization of Banks in Pakistan:

In 1974, the banks in Pakistan were nationalized through an Act called Nationalization Act, 1974. From 1991, the policy of liberalization of economy has been adopted whereby, nationalized banks have been de-nationalized and banking sector has been disinvested. At present banking sector is visibly growing at tremendous pace.

Before we move on to evolution of banking in Pakistan, it would be quite interesting to have a glimpse of historical evolution of banking over a period of time.

Today, we look around us chain of banks rendering host of services to their customers. These banks cater to the commercial and industrial needs of all countries which include die highly developed and industrialized countries, the less developed countries and the countries which are at the take-off stage. Thus there are the industrial banks, the commercial banks, the joint stock banks, the co-operative banks, the agricultural banks, rural development banks, lead banks and so many other types of banks and credit institutions which are functioning. They not only meet the requirements on a national basis, but also on an international basis and what may be called as an ever expanding advancement in banking. The Banks now-a-days are performing so many functions that it would not be a misnomer to suggest that they have become the custodian of the monetary economies of the world. When we talk of great scientific developments and inventions, banking as it stands today is also a wonder of the world.

Banking as we see today is the result of evolutionary development during the course of centuries. It would also be necessary to see how Banking has come to its present stage. There has been all round development in the world and the banking today is not what it was in the earlier rudimentary form. To develop true perception, we need to know as to in what manner Banking today has come to be what it is and in what manner this transition has taken place.

The banking system, as it exists today, is the product of a number of centuries and is not the development of any particular period. In all the countries of the world. Banking has been in existence in one form or the other. So far as the present system is concerned, the word, bank is said to be of Germanic origin, cognate with the French word banque and the Italian word, banca, both meaning bench. In fact, this word may have derived its meaning from the practice of Jewish money-changers of Lombardy, a District in North Italy, who, in the middle ages, used to do business sitting on Benches in the market place. In case such an interpretation is provided, then it also finds support from a number of other derivations of the word such as the French word, Bancjue Route and the Italian word, Banka Rotta, both of which mean Broken Bench. This practice can be understood if we analyze the situation when a money-changer failed and his bench was broken as a result of his failure.

Macleod, however, does not agree with this view and says, "The Italian money-changers as such were never called Benchieri in the middle ages". It may be more correct to say that the word bank is derived from the German word back which means a Joint Stock Fund, which was Italianized into Banco, when the Germans were me masters of a major part of Italy. Professor Ram Chandran Rao has said: "whatever be the origin of the word bank, it would trace the history of banking in Europe from the middle ages

When we come to the Roman age, the State Banks were not functioning but there were private banks duly regulated by the Government. Aristotle stated that:

"Charging of interest on money was unnatural and immoral and on this account, banking could not develop for sometime."

.

We should also remember that in ancient times, commercial banking was associated with the business of money-changing. They also met the financial requirements of the ruling government. Adam Smith has stated as under:

"The earliest banks of Italy, where the name began, were finance companies..... to make loans to and float loans for the government of cities in which they were formed.... After these banks had been long established, they began to do what we call banking business, but at first they never thought of it.

It was only in the 12th century that the Banks, in the modem sense of the term, were established in Venice and Geneva, which were doing the business of receiving deposits and lending money, and were not only money-lenders. In Florence alone, there were about 80 bankers known to the whole of Europe such as Bardi, Medici, Peruzzi and others of great repute. The Bank of Venice founded in 1157, was the first Public Banking Institution. The Bank of Barcelona and the Bank of Geneva were established in 1401 and 1407 respectively and the Bank of the Venice and the Bank of Geneva continued to operate until the end of the 18th Century. The private banking houses such as the famous house of Fuggers and Augsburg enjoyed more eminence than Peruzzi and Bardi in the 14th Century and the Medici in the 15th Century in Italy. The bankers of Lombardy settled in the locality which is now known as the famous Lombard Street in London and to them belonged the credit of planting the seed of modem banking in England. Public banks like the famous Bank of Amsterdam was established in 1609 and these banks helped in the development of trade and commerce. These banks received heterogeneous metallic money and credited deposits in their books which were transferable through bank cheques. Thus, the mercantile payments now began to be settled by means of payment through cheques.

In Britain, people used to deposit their cash and bullion at the Royal Mint having faith in the King and the royal family as an institution.

Edward III exchanged various foreign coins and provided foreign exchange to the travelers and also supplied British money.

This faith was betrayed by Charles I in 1640 A.D. by capturing a very big amount of £1, 30,000 bullion left for safe custody with the Royal Mint. The merchants then started entrusting their valuables and cash to their cashiers, who also misappropriated them, and the merchants took resort to goldsmiths for keeping custody of valuables in their strong rooms. These goldsmiths used to give receipts which were known as Goldsmith's Note, which was made payable to the bearer and on demand which transformed the said receipt into the position of a bank-note which gained circulation and currency in due course of time. These notes with the passage of time became payable to the bearer on demand and enjoyed circulation. Thus, we can say that the goldsmiths became the precursor of the modern, bank-note and the fore-runners of the modem banking institutions.

Thus the development of banking in England was greatly helped by the activities of the London goldsmiths during the age of Queen Elizabeth L For sometime, the deposits were made without interest. Later on, the goldsmiths tarred lending these amounts to others like that of Dutch Bankers and when it was found profitable by them, they started giving interest on this money to their customers instead of charging any fee for safeguarding their money. The goldsmiths started giving loans for long duration and some money was kept by them for daily payments. The trouble arose when Charles 11 under the Cabal Ministry borrowed heavily from them and repudiated all debts there by the goldsmiths as well as English Banking received a rude setback.

Walter Bagehot has stated that the government perpetrated one of those monstrous frauds which are likewise gross blunders. Charles II set up the Exchequer. He would pay to none and as has been stated by Geoffrey Crowther the goldsmiths were ruined. As a result of this, there was the growth of private banks which finally led to the establishment of the Bank of England in 1694. It is again interesting to refer to Geoffrey Crowther to trace the history of modem English banking, who has stated as under:

"The present-day banker has three ancestors of a particular note. One we have already met; the merchant, whose high and widespread reputation or credit enables him to issue documents that will be taken all over the known world as titles to money. To this day the title of "merchant banker” is reserved by usage to the older cosmopolitan and more exclusive private banking firms, nearly every one of which can trace its ancestor to a trader in commodities, more tangible (though hardly more profitable) than money. The banker's two other ancestors are the money-lenders and the goldsmiths. Lending and borrowing arc almost as old as money itself and the village money-lender is found even in quite primitive communities. He is not usually regarded as a very lovely object; usurer is one of the oldest terms of abuse. But the services he performs are undoubtedly useful and necessary, even though the reward he extracts in return may usually be rapacious..... The goldsmith ancestor of the modern bank is purely an English affair.

The goldsmiths were loosing their faith and earned a bad reputation for sometime and people doubted their bona fides. However, they started a new system of having current account with them and the borrowers could withdraw money at any time. This was the stage which gave birth later on to the present banking system. Till then, there was no public bank: The Bank of England was started in 1694 A.D. with its monopoly of issue of notes. There were joint stock companies doing banking business- and they were flourishing in London. These companies introduced deposit banking and cheque currency and many other services which a bank can offer.

So far as the Bank of Amsterdam is concerned, it was one of the greatest banks of the 17th century and its position was not less than the position which was held by the Bank of England. In fact, it had importance in the international world as a whole and one can get a good reference about the working of these banks from Alfred Marshal} who in his book, "Money, Credit and Commerce, 1923", has slated that these famous banks besides, acting as the fiscal agents for the government, were also responsible for the counterpart of such of the work of the modem stock exchanges. In fact, these banks acted as go-between the lenders and borrowers of funds and also as the holders of cash and old securities. In this connection, it would be interesting to refer to Adam Smith who in his famous book, "Wealth of Nationsf/, published in 1776, has described the main function of the Bank of Amsterdam as under:

"This bank received both foreign coin, and light and worn coin of the country at its intrinsic value in the gold standard money of the country, deducting only so much as necessary for defraying the expense of coinage, and the other necessary expense of management. For the value which remained, after this deduction was made, it gave a credit in its books. This credit was called bank money which, as it represented money exactly according to the standard of the mint, was always of the same real value, and intrinsically worth more than current money...., it could be paid away by a simple transfer, without the trouble of counting or the risk of transporting it from one place to another.

We have already seen that the Bank of England was started in 1694 as a result of the actions of Charles II who had borrowed very heavily from the goldsmiths and like his father had repudiated his debts. The Bank of England was also started on account of the financial difficulties of William III who was at war with France. Patterson suggested a way out of difficulties and offered to rise of £1,200,000 which he was prepared to loan to the government if certain concessions including the right to issue notes were given to the proposed institution. For this purpose the Tonnage Act was passed. In the year 1708 another important Act was passed which prohibited any other bank with more than six partners from issuing promissory notes and bank-notes. This Act gave the monopoly of note issue to the Bank of England, so far as the Joint Stock Banks were concerned, but left private banks having not more than six partners free to issue notes. These banks however, thought that the business of note issue was not profitable and they gave it up. Printed cheques were issued for the first time between 1749-59. The Bank of England did not have any branch outside and the private banks started playing an important role. After the middle of the 18th century there were about 300 banks. Then came the crisis of 1825 and it tolled the death knell for the small country banks and of the note as the foundation of the banking system. In 1826 an Act was passed which allowed the banks to be started with unlimited liability, consisting of more than six partners, with the right to issue note provided they had no office within the radius of sixty-five miles from London. Thus the new joint stock banks were started. Even at this time the monopoly of note issue given to the Bank of England by the Act of 1708, was interpreted to mean monopoly of Joint Stock Banking in London because during those days note issue was regarded as the most important as well as the most paying function of banks.

The modem banking institution had to wait for another century and four decades until the passage of the Banking Act of 1833 which provided for the establishment of the Joint Stock Banks.

In 1833, when the Charter of the Bank was revised, as a result of the studies made by one Joplin, a new clause was added and it gave legislative sanction for the establishment of Joint Stocks Banks in London and in 1834, The London and Westminster Bank was started in England, which is the first of the big five ones. In 1844 Peel Act was passed which provided for the extinction of the right of note issue and laid the foundation of the note by Bank of England. With the passing of the Peel's Act, 1844, new banks with the right of note issue could not be started and those which already existed could not increase their circulation and thus greater emphasis was thereby laid on deposit banking and cheque currency.

There was amalgamation of banks after 1890 and the number of Joint Stock Banks in England and Wales came down from 104 in 1890 to 12 in 1956 although the number of bank offices increased from 2203 to 10700 by the end of 1961. The Currency and Bank Note Act, 1920 also regulated the issue of bank-note. The Securities Management Trust Ltd. was organized in 1929. In 1930 Bankers Industrial Development Corporation was formed. In 1947, the Labor Government nationalized the Bank of England and the power to appoint its Governor, Deputy Governors and Directors was vested in the Crown. This Act of the Labor Government had significant impact throughout the world.

“An Act to regulate the acceptance of deposits in the course of '. business; to confer functions on the Bank of England with respect to the control of institutions carrying on deposit-taking businesses; to give further protection to persons who are depositors with such institution to make provision with respect to advertisements inviting the making of deposits; to-restrict the use of names and descriptions associate with banks and banking; to prohibit fraudulent inducement to make deposit; to amend the Consumer Credit Act, 1974 and me law wit respect to instruments to which section 4 of the Cheques Act, applies; to repeal certain enactments relating to banks and banking; and for purposes connected therewith.”

The significance in law of the terms 'bank’, banker' and 'banking business" depends upon the particular operation which is in question an upon the particular statute/if any, under which the question arises. To take an obvious instance, only a banker may reap the benefit of the protective sections contained in different statutes.

In short the effect of the Banking Act, 1979 is, generally speaking, that a person or institution may accept deposits in the course of carrying on deposit taking business for the purposes of the Act unless he or it is a party recognized or licensed by the Bank of England or he or it is exempted or its business falls within the exceptions of section 1(3) or, again, the deposit is I the type included in sub-section (5). Vide section 1(4), 'deposit' is defined as sum of money paid on terms:

(a) Under which it will be repaid, with or without interest or premium, and either on demand or at a time or in circumstances agreed by or on behalf of the person making the payment and the person receiving it; and

(b) Which are not referable to the provision of property or service or the giving of security?

The penalty for contravention is liability to a fine or imprisonment both; but the civil liability of the acceptor of the deposit is not affected.

Thus so far as the English banking system is concerned, the entire matter is now covered by the Banking Act, 1979 which governs all the important aspects of the banking life in England

As per Sheldon's "Practice and Law of Banking", 10th Edn., p. 163, so far as the classification of banks is concerned, firstly, there is the Bank of England, incorporated by Royal Charter and not affected by the Companies Act. Secondly, there are the National Saving Banks, the National Giro and the Trustee Saving Banks. Thirdly, there are the great Joint Stock Banks, registered under the Companies Act with limited liability. Fourthly, there is at least one Joint Stock Bank with unlimited liability, namely, C. Hoare & Co., Coutts & Co. which is now a wholly owned subsidiary of National Westminster Bank Ltd. though it is still a clearing bank in its own right. There used to be many banking partnerships with unlimited liability but, with N.M. Rothschild & Sons becoming a limited company in 1970, it seems that there remains no banking partnership in England and Wales of any size. , Fifthly, there are the Scottish, .Irish, Overseas and Foreign Banks whose principal places of business are outside the precincts of England and Wales. Some of the earlier overseas banks were incorporated by Royal Charter, e.g., the Chartered Bank, British Bank of the Middle East, and so on. Sixthly, there are so called Merchant Banks, which are now without exception incorporated under the Companies Act, the shares of many of them being quoted on the London Stock Exchange. These banks are engaged in deposit banking but their more important role is in the provision of finance, both by way of loan and acceptance credit and in acting as financial advisers to a large range of commercial companies/especially where 'take-over bids', mergers and amalgamations are concerned. Most of them are also prepared to act as investment advisers.

In conclusion, we can say that banking is not a static rather it is a dynamic concept. It is product of centuries and the development which has taken place is the product of the method of trial and error and experiences which were made and the results that followed relating to the acceptance of money and valuables as deposits, keeping them as such, lending them, whether to private individuals or to states or other bodies and for controlling the multifarious and multi-dimensional activities which in the beginning were only trivial and could be ignored but with the growth of time, became international in character and multi-dimensional in nature calling for actions on the part of the states as the actions on the part of the individuals failed and state control became eminent. Thus, one cannot understand the development of banking merely by looking at a particular period of time and one will have to consider the development by taking into account the progress as it has taken place during the centuries and by understanding the movement from one stage to the other.

Evolution of banking in Pakistan:

Commercial banks constitute the most important source of institutional credit in the economy. As the country’s largest deposit institutions and the main source of short-term credit, they form the heart of the financial system.

At the time of independence, there were two banks incorporated in the undivided India in first half of 1940s’ whose owners were Muslims. After independence they decided to establish their head office in Pakistan, thus laying the foundation of banking in this country.

The National Bank of Pakistan was set up in November 1949 in crises conditions following the first trade deadlock with India. The original intention was to establish it sometime in 1950. The plans for its establishment had to be advanced in view of the critical situation, which developed especially in the jute trade as a result of India’s refusal to accept the exchange rate of the Pakistani Rupee following the Indian devaluation of 1949. The bank was set up through an Ordinance on 19 November 1949 and started its operations with five offices located at important jute centres. It played a notable role in financing the jute trade in collaboration with the Jute Board. In 1952, the National Bank of Pakistan took over the agency work of the State Bank of Pakistan to transact government business and manage currency chests at places where the state bank did not have an office of its own.

Prior to nationalization, the government owned 25 percent of the share capital while others held the remaining 75 percent. Following nationalization, the capital held by others was transferred to and invested in the federal government. Prior to nationalization, a Central Board of Directors governed the National Bank but consequent upon nationalization, the Central Board was dissolved and in its place an Executive Board consisting of a President who is the chief executive and four other members were appointed for the general direction and superintendence of the affairs and business of the bank.

All Pakistan banks were nationalized with 100 percent federal government ownership in 1974 and by now all nationalized banks stand disinvested and privatized. These aspects shall be discussed in detail in due course of time’

There were as many as thirty-four foreign banks with 172 branches at the time of in dependence. With the closure of many of the banks, the number had declined to twenty-one by June 1980. The Indian Banks, which numbered nine were entrusted to the Custodian of Enemy Property after the 1965 Indo-Pak war. Among foreign banks, a distinction was usually made between banks having their head offices in India and those with head offices in other countries. Foreign banks, other than the Indian banks, were commonly known as exchange banks in the early years. The term owed its origin to the fact that, prior to independence; foreign banks in the Indo-Pakistan subcontinent were engaged primarily in the financing of foreign trade. Seven exchange banks incorporated abroad were operation in Pakistan at the time of independence. Most of thse banks were of British origin. There were twenty-nine Indian Banks operating in the territories of Paksitan at the time of Independence but they gradually curtailed their business and their number stood at nine in 1965 when they were taken over by the Custodian of Enemy Property. The banks that were taken over were: (1) State bank of India; (2) Central Bank of India Ltd.; (3) Bank of India Ltd.; (4) United Commercial Bank Ltd.; (5) Punjab Commerce Ltd.; (7) United Bank of India Ltd.; (8) Bank of Baroda Ltd.; and (9) United industrial bank Ltd. Besides, there were as many as twelve non-schedule Indian banks which were also taken over by the Custodian of Enemy property following the 1965 Indo-Pakistan War.

Very few foreign banks have been attracted to Pakistan during the financial liberalization period. Indeed several have sold out to private Pakistani banks and terminated operations in Pakistan.

Evolution of Commercial Banks in Pakistan

As already discussed that at the time of independence, there were only two banks, which were incorporated in undivided India and whose owners were Muslims ,they opted to shift their Head Offices in Pakistan. With the establishment of SBP, the other banks also came into existence and by 1973 number of banks increased to fourteen.

Nationalization of Banks in Pakistan:

In 1974, the banks in Pakistan were nationalized through an Act called Nationalization Act, 1974. From 1991, the policy of liberalization of economy has been adopted whereby, nationalized banks have been de-nationalized and banking sector has been disinvested. At present banking sector is visibly growing at tremendous pace.