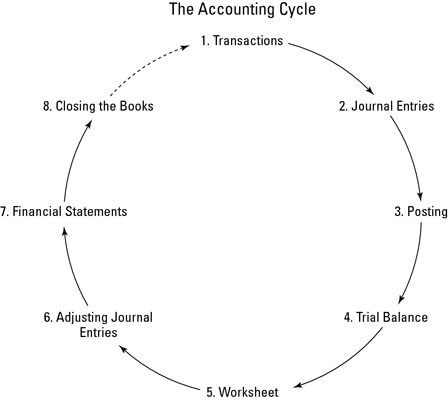

Accounting cycle is a step-by-step process of recording, classification and summarization of economic transactions of a business. It generates useful financial information in the form of financial statements including income statement, balance sheet, cash flow statement and statement of changes in equity.

The time period principle requires that a business should prepare its financial statements on periodic basis. Therefore accounting cycle is followed once during each accounting period. Accounting Cycle starts from the recording of individual transactions and ends on the preparation of financial statements and closing entries.

Major Steps in Accounting Cycle

Following are the major steps involved in the accounting cycle. We will use a simple example problem to explain each step.

Transactions

Financial transactions start the process. Transactions can include the sale or return of a product, the purchase of supplies for business activities, or any other financial activity that involves the exchange of the company’s assets, the establishment or payoff of a debt, or the deposit from or payout of money to the company’s owners.

Journal entries

The transaction is listed in the appropriate journal, maintaining the journal’s chronological order of transactions. The journal is also known as the “book of original entry” and is the first place a transaction is listed.

Posting

The transactions are posted to the account that it impacts. These accounts are part of the General Ledger, where you can find a summary of all the business’s accounts.

Trial balance

At the end of the accounting period (which may be a month, quarter, or year depending on a business’s practices), you calculate a trial balance.

Worksheet

Unfortunately, many times your first calculation of the trial balance shows that the books aren’t in balance. If that’s the case, you look for errors and make corrections called adjustments, which are tracked on a worksheet.

Adjustments are also made to account for the depreciation of assets and to adjust for one-time payments (such as insurance) that should be allocated on a monthly basis to more accurately match monthly expenses with monthly revenues. After you make and record adjustments, you take another trial balance to be sure the accounts are in balance.

Adjusting journal entries

You post any corrections needed to the affected accounts once your trial balance shows the accounts will be balanced once the adjustments needed are made to the accounts. You don’t need to make adjusting entries until the trial balance process is completed and all needed corrections and adjustments have been identified.

Financial statements

You prepare the balance sheet and income statement using the corrected account balances.

Closing the books

You close the books for the revenue and expense accounts and begin the entire cycle again with zero balances in those accounts.

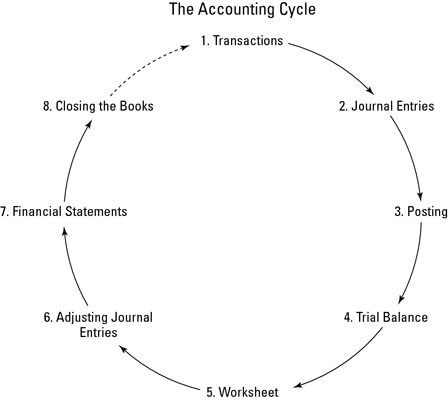

The time period principle requires that a business should prepare its financial statements on periodic basis. Therefore accounting cycle is followed once during each accounting period. Accounting Cycle starts from the recording of individual transactions and ends on the preparation of financial statements and closing entries.

Major Steps in Accounting Cycle

Following are the major steps involved in the accounting cycle. We will use a simple example problem to explain each step.

- Analyzing and recording transactions via journal entries

- Posting journal entries to ledger accounts

- Preparing unadjusted trial balance

- Preparing adjusting entries at the end of the period

- Preparing adjusted trial balance

- Preparing financial statements

- Closing temporary accounts via closing entries

- Preparing post-closing trial balance

Transactions

Financial transactions start the process. Transactions can include the sale or return of a product, the purchase of supplies for business activities, or any other financial activity that involves the exchange of the company’s assets, the establishment or payoff of a debt, or the deposit from or payout of money to the company’s owners.

Journal entries

The transaction is listed in the appropriate journal, maintaining the journal’s chronological order of transactions. The journal is also known as the “book of original entry” and is the first place a transaction is listed.

Posting

The transactions are posted to the account that it impacts. These accounts are part of the General Ledger, where you can find a summary of all the business’s accounts.

Trial balance

At the end of the accounting period (which may be a month, quarter, or year depending on a business’s practices), you calculate a trial balance.

Worksheet

Unfortunately, many times your first calculation of the trial balance shows that the books aren’t in balance. If that’s the case, you look for errors and make corrections called adjustments, which are tracked on a worksheet.

Adjustments are also made to account for the depreciation of assets and to adjust for one-time payments (such as insurance) that should be allocated on a monthly basis to more accurately match monthly expenses with monthly revenues. After you make and record adjustments, you take another trial balance to be sure the accounts are in balance.

Adjusting journal entries

You post any corrections needed to the affected accounts once your trial balance shows the accounts will be balanced once the adjustments needed are made to the accounts. You don’t need to make adjusting entries until the trial balance process is completed and all needed corrections and adjustments have been identified.

Financial statements

You prepare the balance sheet and income statement using the corrected account balances.

Closing the books

You close the books for the revenue and expense accounts and begin the entire cycle again with zero balances in those accounts.